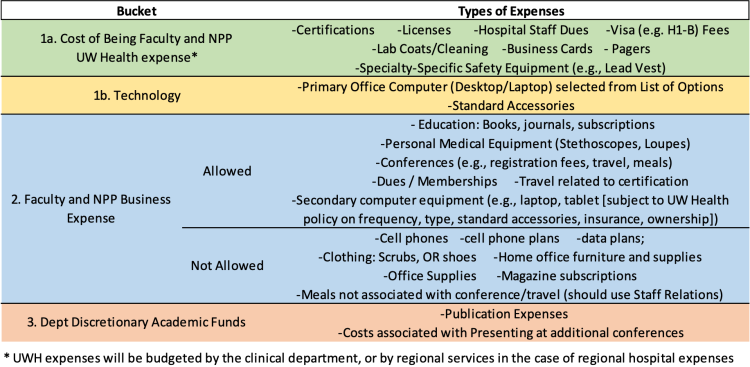

UWMF provides a business allowance to faculty physicians and NPP's to support clinical work. These expenses are grouped into three categories:

- 1a and 1b. Departmental Expenses to Support Clinical Work

The expenses in this category will be covered by the department to support the clinical work of the employee. They will not be prorated by FTE.

- Board Certification(s): The department will cover fees for initial written/oral certification examination(s) and maintenance of certification fees. If a faculty physician is maintaining more than one certification as required for their role, these fees will be covered under this guideline.

- License Fees: State license fees will be covered, along with DEA license fees, as needed to perform the assigned work.

- Hospital Staff Dues: Madison-area hospital staff dues and credentialing fees are covered. Regional hospital dues and fees are covered by Regional Services.

- Specialty-specific Safety Equipment: Departments may identify special safety equipment (e.g., lead shields) that are required to support the clinical work of the employees in the department. Items in this category will be reviewed on a regular basis by the Professional Business Expense Workgroup.

- Lab Coats and Cleaning Fees: The purchase of three lab coats every three years, along with cleaning expenses will be covered.

- Other Support: The department will also support the cost of other expenses that support the professional work of the employee. Items in this category (e.g., pagers, business cards, H-1B Visa expenses, etc.) will be determined by the department.

- 2. Faculty and NPP Business Expense

The expenses in this category are designed to support the professional development of the faculty and NPPs. The standard allocation for physicians, prorated by start date, will be provided for all faculty with at least 0.2 FTE. The individual professional allowance allocation for NPPs is identified in the UW Health Non-Physician Provider Professional Expense Allowance and Continuing Professional Education Policy.

Included Expenses

- Conferences (registration fees, travel expenses, meals)

- Dues/memberships for medical organizations related to your specialty

- Educational materials such as medical/professional books, journals, subscriptions

- Personal medical equipment such as stethoscopes

- Secondary computer equipment (e.g., laptop or tablet [subject to DOM policies on frequency, type, and ownership], standard accessories)

- Travel expenses related to board certification/recertification

- Podcasts related to clinical activity

- Ear buds. Limit is 1 reimbursed per fiscal year with a maximum reimbursement of $150 per purchase.

- Repairs to laptop or ipad

Excluded Expenses

- Cell phones, cell phone accessories, cell phone plan costs

- Furniture, including frames

- Artwork

- Stereo systems including a sound bar

- Donations

- Meals not associated with conferences/travel (may be reimbursable under Staff Relations expenses)

- Non-medical magazine subscriptions

- Office supplies

- Personal clothing items such as scrubs, shoes, etc

- Computer carrying bag

- Purchase of Clinical Equipment is not allowed via professional business expense allowance. All requests to purchase clinical equipment must follow UW Health’s Medical Equipment Management Plan

Important Policy notes:

A faculty member may not give their professional development funds to another employee to pay for parking spaces, airfare for conference attendance not funded by their department, etc., since this would be considered a gift to that employee and taxable. UW Health Policy 1.64

- 3. Department Discretionary Academic Funds

UW Health provides additional funds to academic departments to support their academic missions.

Use of these funds has been placed on temporary hold at the direction of the department chair. Please check back later for updates.

Examples of what these funds can be used for:

- Publication fees when you are the first or senior author: Publications fees should be paid for by use of a UW purchasing card or a direct payment. Do not use personal funds to pay for these items.

- Presenting at meetings: travel reimbursement may be provided for faculty serving as a first/senior author or an oral or poster presentation at a scientific meeting, or when the faculty is giving an invited talk or is serving in an official role within the organization.

- Professional development: attending an educational training/seminar.

For more detailed information please visit the Internal Funding Opportunities page.

Business Expense Guidelines

Faculty Physicians

Physician Business Allowance is $4,000 each Fiscal Year (July 1 - June 30).

Allowable carry over from one fiscal year to the next is 50% of the annual allocation, (i.e. maximum is $4,000, up to $2,000 can be carried over for 1 year) Central Finance will coordinate with divisions to verify balances at fiscal year-end. The carry over amount reflected in your available balance at the beginning of each new fiscal year.

Non-Physician Providers (NPP)

The NPP Business Allowance is $2,000 each Fiscal Year (July 1 - June 30) and is not pro-rated for FTE.

Allowance of carryover from one fiscal year to the next is 50% of the annual allocation, (i.e. maximum is $2,000, up to $1,000 can be carried over for 1 year). Central Finance will coordinate with divisions to verify balances at fiscal year-end. The carry over amount reflected in your available balance at the beginning of each new fiscal year.

Additional Information

Travel Guidance

If you are booking travel to be paid for using professional funds you must use the UW Health booking system. Therefore, at the time of each booking, physicians will need to confirm the funding source for their travel. For more details please visit our Travel Planning and Policies page

For Non-Physician Providers travel must be booked per UW Health (Legacy UWMF) policy.

Expense Types with Special Instructions

Technology Purchases

In order to be considered an allowable business expense all technology MUST be purchased and supported by SMPH IT. Any Information technology equipment purchased via this policy must be returned to the department upon departure of any individual. (This includes, but is not limited to: ipads, laptops, desktops, etc.)

Clinical Equipment

The purchase of Clinical Equipment is not allowed via professional business expense allowance. All requests to purchase clinical equipment must follow UW Health’s Medical Equipment Management Plan

DEA License Renewals

The DEA grants fee exemptions to employees of the University of Wisconsin-Madison. This includes physicians who have a dual appointment with UW Medical Foundation. This is because UW-Madison employed physicians and other practitioners are State of Wisconsin employees for purposes of their clinical, teaching and research activities. Individuals who are 100% employees of UW Medical Foundation (e.g., UWMF NPs and PAs) are NOT fee exempt.

For further information, please visit the Office of Legal Affairs website, or speak with the attorney on call at 263-7400.

Mileage Reimbursement for Outreach Sites

See the Regional Services Workflow

Questions or comments?

Contact Mickie Dickrell, (608) 265-2120, mmd@medicine.wisc.edu